De-constructing IPOs

The Advent of the SME IPO Era:

Part 1:

India has a large pool of Small and Medium-sized Enterprises (SMEs).

SMEs contribute to over 30% of it's GDP, 45% of industrial production, 40% of export and employ over a 100 million people.

In recognition of their significance, the Government has undertaken several initiatives to promote & support their growth.

SEBI has eased listing requirements for SMEs, making it easier for them to access capital markets. The NSE & BSE have introduced SME platforms to facilitate capital raise.

SMEs have collectively raised ~INR 13,500 Cr. through 900 IPOs over 12 years, with ~INR 4,700 Cr. in CY 2023 alone.

Part 2:

Listed SMEs have outperformed the wider indices (NIFTY 50, BSE 500) in the last few years, leading to significant interest in the asset class.

SMEs are emerging as an “acceptable” asset class amongst intuitional investors, given their potential for higher returns & diversification.

The growing focus on SME IPOs has led to increased research coverage & media attention, enhancing visibility.

The era of significant investor interest in SMEs has only just started – and if their fundamentals hold, this interest will expand.

Part 3:

While an IPO is a one-time event, businesses will need to access the capital markets continually to fund expansion

For a well-prepared company, an IPO sets the stage for robust long-term growth

IPO; A Gateway to Growth

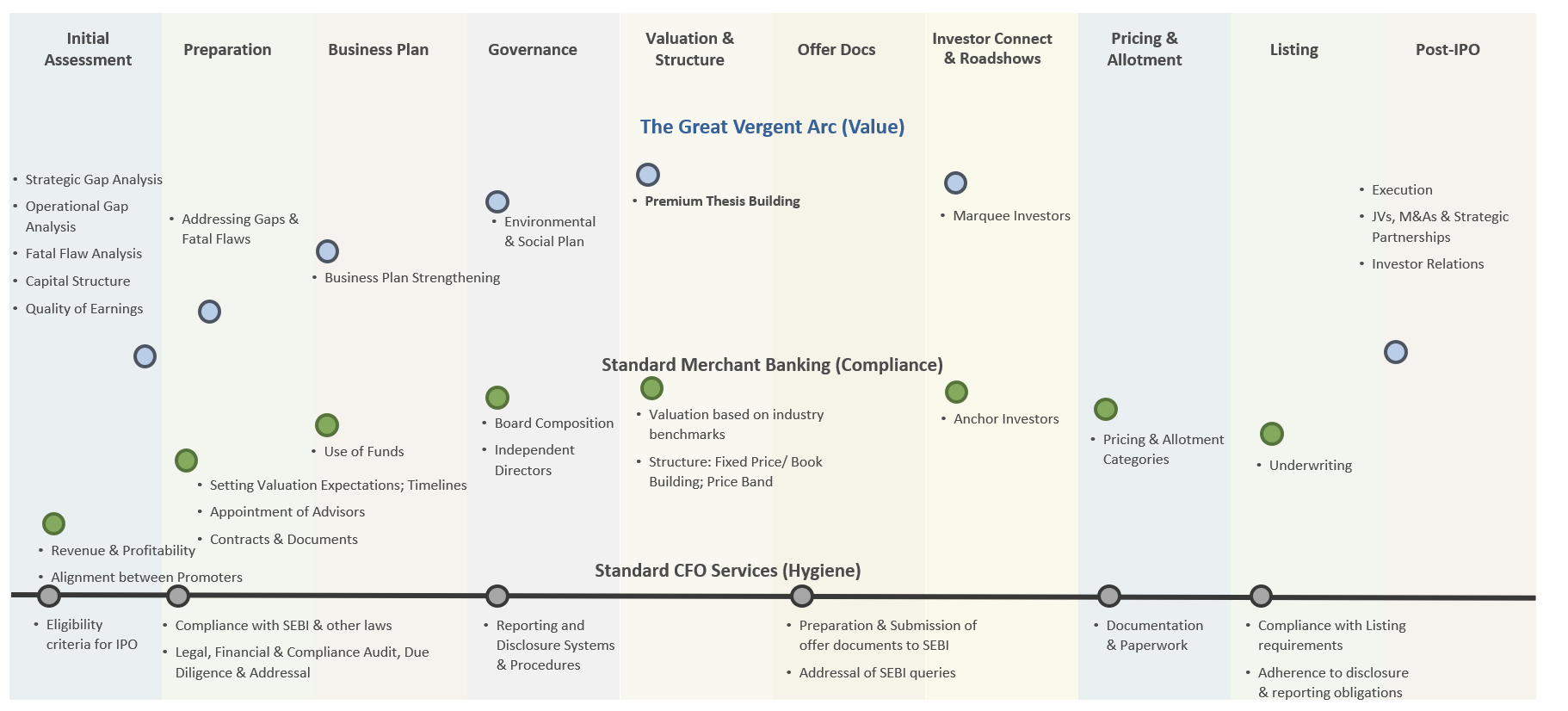

Deconstructing the IPO:

IPO; an Opportunity to Reposition

The Great Vergent Value Arc:

Know-How completes the picture!

Solid Groundwork makes for a Great IPO; with the ability to Re-Visit the Markets as Bonus

Related Reading:

SMEs contribute to over 30% of India’s GDP, 45% of industrial production, 40% of export and employ over a 100 million. SMEs face significant challenges on account of their size.